Among the most important challenges facing our nation today is the need to invest in infrastructure. Today, we are living at risk: driving on eroding roads and bridges, questioning whether our water is safe to drink, and falling behind economically. With these problems growing worse, it’s time for the Great American Rebuild.

BPC’s Executive Council on Infrastructure released recommendations to achieve a New American Model for Investing in Infrastructure. This new model aims to increase the flow of private capital into U.S. infrastructure projects by:

- Addressing the pervasive underappreciation of future infrastructure liabilities in America;

- Encouraging partnerships with the private sector to share risks and maximize the value the public receives from infrastructure assets; and

- Ensuring communities across the country have tools to make necessary investments.

Helping State and Local Governments Attract Private Investors

Pass Enabling Legislation

Public-Private Partnership (P3) Model State Legislation

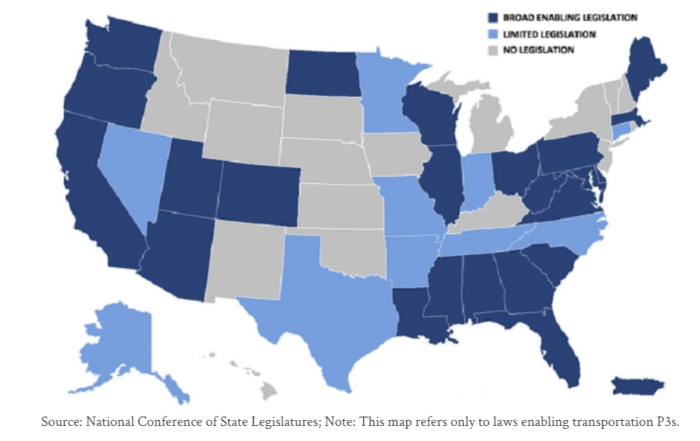

All states should adopt broad enabling legislation to allow for the full range of partnerships between the public and private sectors for all types of infrastructure. Seventeen states do not allow public-private partnerships (P3) for infrastructure at all, and, even among those that do have P3 laws, existing statutes are most often limited to the use of P3s for specific types of infrastructure—particularly transportation—or include provisions that make alternative procurements difficult in practice—such as prior legislative approval.

States with P3-Enabling Legislation

Build In-House Expertise

Lessons from Public-Private Partnerships

Nationwide, actual experience with negotiating and delivering P3s is limited. States should establish expert offices to provide technical assistance and serve as one-stop shops for private investment in infrastructure for the state. This will help combat the inertia among public agencies that leads them to using familiar, conventional methods of procurement without exploring alternatives that could reduce costs or result in better infrastructure over the long term.

Inventory Public Assets

All public infrastructure owners should develop a complete list of infrastructure assets owned, the condition of the assets, cost of maintaining over remaining useful life, cost of replacement, and the potential impact of a failure. Lack of information about the full scope of future costs and risks skews decision-making toward short-term priorities, not long-term needs.

Expedite Permitting

Where possible, states should help ensure early identification of all necessary permits, clearly delineate decision-making authority, utilize simultaneous – not sequential – permitting processes, and prioritize consensus-building and transparency.

Prioritize Long-Term Value

Public agencies should prioritize infrastructure needs and match projects with the most cost-effective delivery and financing options. States can make strategic choices in project delivery to maximize long-term value and save public dollars while incentivizing localities to follow suit.

Use Innovative Funding

Public funding will continue to be essential for modernizing infrastructure. But project sponsors should also maximize the use of emerging funding sources that directly engage the private sector: value capture, naming rights, crowdfunding, and private development capital. Failure to embrace these options leaves dollars on the table.

PODCAST: The Infrastructure Debate

Listen to BPC’s monthly podcast with infrastructure experts discussing all sides of the issues.

Available online, through Stitcher, and Apple Podcasts.